5G tipping point: Industry and consumers lured with cheaper, smarter services

Ericsson landed on its corporate feet when it parachuted out of the GSMA‘s Mobile World Congress last Friday. For the last few years, the network solutions provider has (like Huawei and a few others) hosted Pre-MWC Briefings for media and analysts in key markets, in an attempt to catch attention ahead of the pandemonium in Barcelona.

Only this year, the new corona virus has brought the lights down on #MWC20 before it could even open its doors. So, the pre-existing invitation assumed new importance, says editorial director, Jeremy Cowan, as industry observers gathered to hear what Ericsson plans for 2020.

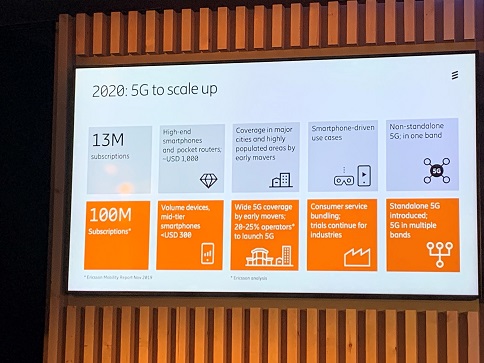

According to Fredrik Jejdling, EVP and head of Business Area Networks, 2019 was the year that 5G “took off”, with the Sweden-based vendor’s customers notching up 13 million 5G subscribers worldwide. This was predominantly in high-end (approximately $1,000) smartphones and routers, with coverage provided in major cities and highly populated areas. Use cases were smartphone-driven, for non-standalone 5G, in one band.

Fredrik Jejdling: 2019 was the year that 5G ‘took off’.

Things will be very different in 2020, he maintains. The Ericsson Mobility Report, a research programme published in November 2019, forecasts that the company’s customers will achieve 100 million subscriptions this year, providing services for volume devices, including mid-tier ($300) smartphones. Some 20-25% of network operators will offer 5G services by year end, with consumer service bundles and ongoing trials for industries, standalone 5G introduced, and multiple bands.

5G for consumers

Ericsson points to ConsumerLab research from May 2019 that indicates half of all consumers are willing to pay a 20% premium for 5G over 4G. Operators can achieve higher Average Revenue Per User (ARPU) by offering added value to consumers beyond data and speed. Many operators are expected to offer 5G service bundles with their ecosystem partners; with services such as immersive media, cloud gaming and Live event experiences.

5G for industries

With its partner Telefonica Germany, Ericsson is building a private 5G network in Germany for Mercedes-Benz. This is designed to facilitate data linking on the assembly line.

5G is now a reality for automotive manufacturing at Germany’s electric microcar company, e.GO Mobile AG at its complex in Aachen, according to Jejdling.

Still in the pipeline, Ericsson, Telia and Einride are co-operating to develop autonomous driving trucks. One driver can, they report, control 10 trucks. This represents a 60% saving in OpEx.

The company knows it has to practise what it preaches. “We’re drinking our own Kool-Aid,” Jejdling concedes, with 5G enabling smart manufacturing in Ericsson’s own supply chain. Factories in Estonia, China, an Brazil have all been modernised and automated, by implementing cellular Internet of Things (IoT), 5G, Industry 4.0 automation and artificial intelligence (AI). The company is now setting up a new 5G ‘smart factory’ in Texas.

Global roll-out

Ericsson can now point to 24 live 5G networks in 14 countries. These range from the four national network operators in the US, to Vodafone in Ireland, the UK, Spain and Germany, through DiGi and Orange Romania, to Etisalat, SK Telecom and Optus, to name just a few.

Huawei and Ericsson both claim 5G leadership. Nokia not so much. Ericsson bases its claim on having signed 81 commercial 5G agreements; or it could be because it has 65% of all 5G deployments in US cities; it may also be the 40+ commercial 5G devices which it says is the widest ecosystem of supported 5G devices on live networks. Then again, it could be the 90% nationwide 5G coverage achieved by Swisscom with Spectrum Sharing and a 5G low band. The claim will doubtless be challenged next week at Huawei’s briefing.

What’s next?

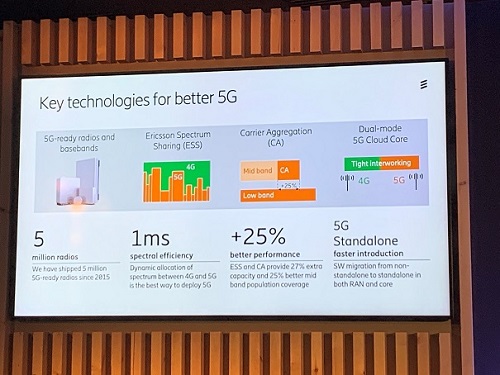

Ericsson’s technologies for better 5G: Key amongst them is dynamic spectrum sharing.

Fredrik Jejdling says that Ericsson is focusing on innovation, efficiency and performance in its pursuit of a better 5G. Innovation means use case-centric technologies, applied across the ecosystem. For 5G and beyond, you can expect greater openness (the company is part of ORAN, the Open RAN Group), and network virtualisation will be key.

Finally, the company places great emphasis on 1ms spectral efficiency with Ericsson Spectrum Sharing (ESS), dynamically allocating spectrum between 4G and 5G. That and Carrier Aggregation reportedly provide 27% extra capacity and 25% better mid-band population coverage. “ESS is the only way to make use of existing bandwidth to use 4G or 5G depending on which protocol is available,” Jejdling concludes.

Comment on this article below or via Twitter:

The author is Jeremy Cowan, editorial director & publisher of IoT Now, VanillaPlus and The Evolving Enterprise.

Recent Posts

- What Is an Exoskeleton Suit?

- Where can you use an ultrasonic motor?

- Smart Camera: System That You Can Use for a Wide Variety of Purposes

- Why Is the Smart Toothbrush Better Than a Regular One?

- Microcontrollers: An Integral Part of Embedded Hardware

- Air Quality Monitoring System: Why It’s So Important in Modern Realities